Introduction to Bearing Factory Operations

The global bearing industry serves as a critical enabler for modern machinery, with factories playing a pivotal role in manufacturing high-precision components that reduce friction and maintain rotational accuracy across diverse applications. Bearing factories combine advanced metallurgy, precision engineering, and rigorous quality control to produce components that withstand extreme loads and operating conditions. This section examines the market landscape and key applications driving demand for bearing factory outputs.

Market Overview

The bearing industry demonstrates robust growth globally, with the market size projected to expand from 130.2billionin2022to130.2billionin2022to279.8 billion by 2032, reflecting a 7.9% CAGR (市场预测:预计到2032年全球轴承行业市场规模将达到2,798亿美元). China represents the fastest-growing regional market, accounting for 25% of global production volume in 2021 with 2,278 billion RMB revenue and 23.3 billion bearing units manufactured (国内外轴承行业发展与下游应用市场分析报告|轴承).

Key market players exhibit a stratified competitive landscape:

| Market Tier | Representative Companies | Market Share (2022) |

|---|---|---|

| Global Leaders | SKF (Sweden), Schaeffler (Germany), NSK/NTN (Japan), TIMKEN (USA) | 75% |

| Chinese Domestic | Wanxiang, LYC, Wafangdian, Tianma | 20% |

The industry faces intensifying competition as Chinese manufacturers progress from producing 66,000 bearing varieties in 2005 to over 90,000 by 2019, though high-end segments remain dominated by international firms (市场预测:预计到2032年全球轴承行业市场规模将达到2,798亿美元).

Key Applications

Bearing factories supply critical components across three primary industrial sectors:

Automotive Industry (37% market share)

- Engine systems: Crankshaft and camshaft bearings

- Transmission assemblies: Gearbox and differential bearings

- Wheel hubs: Precision tapered roller bearings for EVs (国机精工:公司轴承应用领域主要为航天航空、精密机床、风力发电、冶金矿山、工程机械等)

Industrial Machinery

- Wind turbines: Multi-row cylindrical roller bearings for main shafts

- Mining equipment: Extra-large spherical roller bearings

- Machine tools: High-speed angular contact bearings for spindles

Aerospace & Defense

- Aircraft engines: High-temperature alloy bearings

- Satellite mechanisms: Vacuum-grade precision bearings

- Radar systems: Ultra-low friction instrumentation bearings

Emerging applications in robotics and medical devices are driving innovation in miniature and ceramic bearing technologies. The wind energy sector particularly demonstrates accelerated demand, with China’s installed capacity growth creating sustained need for specialized bearings (轴承行业未来趋势展望:创新与发展的浪潮来袭!【技术分析】).

Bearing Factory Production Process

The production of precision bearings demands micrometer-level accuracy, with tolerances as tight as 0.001mm for aerospace-grade components. This exacting process combines metallurgical science with advanced manufacturing technologies to create friction-reducing systems capable of sustaining radial loads exceeding 300kN while maintaining rotational precision over 50,000 operating hours (轴承的生产工艺流程).

Raw Material Selection

Bearing factories employ specialized alloys and ceramics to meet diverse operational demands:

| Material Type | Composition | Key Properties | Typical Applications |

|---|---|---|---|

| High-carbon chromium steel (GCr15) | 1.5% carbon, 1.5% chromium | HRC 60-64 hardness, 2,200MPa fatigue strength | Automotive wheel bearings, industrial gearboxes |

| Case-hardened steel | SAE 8620 modified | Surface hardness HRC 58-62 with tough core | Mining equipment bearings |

| Silicon nitride ceramic | Si₃N₄ with Y₂O₃ additives | 1,400°C thermal stability, 50% steel density | High-speed machine tool spindles |

| Hybrid ceramics | Steel races with ceramic balls | 3× steel lifespan, 80% friction reduction | EV motor bearings |

The material selection process involves rigorous testing:

- Spectroscopic analysis verifies alloy composition within ±0.05%

- Ultrasonic inspection detects subsurface defects >50μm

- Hardness mapping ensures uniform material properties (如何正确选择合适的轴承材料:优化设备性能的重要步骤)

Manufacturing Steps

Precision forging

- Induction heating to 1,150°C for optimal grain flow

- Closed-die forging under 8,000-ton presses achieves 95% material utilization

Heat treatment

- Carburizing at 930°C for 8-12 hours creates 1.2mm case depth

- Cryogenic treatment at -196°C stabilizes austenite transformation

Grinding processes

- CNC centerless grinding achieves Ra 0.05μm surface finish

- CBN wheel technology maintains ±2μm dimensional accuracy

Superfinishing

- Oscillating stone polishing reduces surface waviness to <0.1μm

- Micro-geometry correction optimizes load distribution (轴承生产工艺流程)

Quality Control Measures

Bearing factories implement multilayered inspection protocols:

In-process checks

- Automated laser scanning verifies dimensional tolerances every 50 parts

- Eddy current testing detects subsurface flaws in 100% of heat-treated components

Final validation

| Test Category | Equipment | Standard | Acceptance Criteria |

|---|---|---|---|

| Fatigue life | ABFT-3000 rig | ISO 281 | L10 >1 million cycles |

| Noise level | ANSI S2.25 chamber | DIN 620-6 | <45dB at 1,800rpm |

| Vibration | FFT analyzers | ISO 15242 | Z1 <28dB for P5 grade |

Certification compliance includes:

- IATF 16949 automotive standards with 8D problem-solving protocols

- ISO 24652 for hydraulic cylinder bearings (我国主导制定的滚动轴承领域国际标准ISO 24652正式发布_标准化)

- DIN 648 for joint bearing specifications (轴承技术标准 DIN)

The production process integrates Industry 4.0 technologies, with 92% of critical parameters monitored in real-time through IoT sensors, ensuring traceability from raw material to finished bearing.

Quality Standards and Certifications

Introduction to the Importance of Adhering to International Standards in Bearing Manufacturing

In the precision-driven bearing industry, adherence to international standards is not merely a regulatory requirement but a fundamental pillar ensuring operational excellence and product reliability. These standards establish uniform benchmarks for dimensional accuracy, material properties, and performance characteristics, enabling bearing factories to produce components that meet global interoperability requirements. Compliance with ISO, DIN, and other internationally recognized standards directly correlates with reduced friction losses (up to 30% in high-speed applications) and extended service life exceeding 50,000 operational hours in industrial machinery (轴承工厂质量控制体系构成要素).

The implementation of standardized processes mitigates supply chain risks, as 78% of global OEMs mandate ISO-certified suppliers for critical components. Moreover, standardized bearings demonstrate 40% lower failure rates in extreme conditions compared to non-compliant alternatives, as validated by fatigue tests under ISO 281 protocols (滚动轴承公司质量管理体系标准).

International Standards

Overview of Key Standards and Their Relevance to Bearing Production

ISO 24652 (Joint Bearing Specifications)

- Defines hydraulic cylinder rod-end joint bearings’ load distribution and surface hardness requirements (HRC 58-62)

- Mandates 2,200MPa minimum fatigue strength for construction equipment applications (我国主导制定的滚动轴承领域国际标准ISO 24652正式发布)

DIN 648 (Joint Bearing Technical Specifications)

- Specifies 0.001mm tolerance for aerospace-grade spherical plain bearings

- Requires ultrasonic testing for subsurface defects >50μm in critical applications (轴承技术标准 DIN)

ISO 15242 (Vibration Measurement)

- Classifies vibration levels into Z1-Z4 categories, with P5 precision bearings requiring <28dB at 1,800rpm

- Adopted by 92% of European wind turbine manufacturers for main shaft bearing validation

ISO 9001 (Quality Management Systems)

- Implements PDCA (Plan-Do-Check-Act) cycle for continuous process improvement

- Reduces manufacturing defects by 35% through standardized documentation protocols (轴承ISO认证是什么标志?这个标志有什么含义?)

Industry Certifications

Detailed Look at Certifications and Their Requirements

| Certification | Key Requirements | Bearing-Specific Clauses | Validity Period |

|---|---|---|---|

| IATF 16949 | – 8D problem-solving methodology – Process capability index CpK≥1.67 | Special process validation for heat treatment (e.g., carburizing depth control ±0.05mm) | 3 years with bi-annual surveillance audits |

| ISO 14001 | – Carbon footprint tracking – Waste reduction targets | Mandatory recycling of grinding sludge (minimum 85% recovery rate) | 3 years with annual compliance checks |

| EAC TR CU 032/2013 | – GOST R material certification – -40°C to +150°C operational testing | Full traceability from raw material to finished bearing | 1-5 years depending on batch type |

For IATF 16949 certification, bearing factories must implement:

- SPC (Statistical Process Control) for 100% of critical parameters (e.g., raceway curvature radius ±2μm)

- MSA (Measurement System Analysis) ensuring gauge R&R <10% for CMM equipment

- PFMEA (Process Failure Mode Effects Analysis) addressing risks like improper hardening depth (IATF16949认证的核心内容有哪些 ISO9001认证的申请流程详解)

Compliance and Testing

Testing Protocols and Compliance Measures

Bearing factories employ a multi-layered verification system:

Material Validation

- Spectrographic analysis verifying alloy composition (e.g., GCr15 steel containing 1.5% Cr ±0.03%)

- Charpy impact tests at -196°C confirming austenite transformation stability

Dimensional Verification

- Automated laser scanning every 50 parts (accuracy: ±0.5μm)

- CBN wheel grinding maintaining ±2μm concentricity (确保轴承质量的检验标准流程)

Performance Testing

- ABFT-3000 rigs conducting accelerated life tests (L10 >1 million cycles at 300kN radial load)

- ANSI S2.25 chambers measuring noise levels (<45dB for precision electric motor bearings)

Environmental Compliance

- REACH SVHC testing for <0.1% lead content in plating materials

- RoHS certification for electrical insulation components in hybrid bearings

The 5M1E (Man, Machine, Material, Method, Environment, Measurement) framework governs comprehensive quality control:

- Man: Mandatory NAS-410 certification for NDT technicians

- Machine: Annual calibration of grinding machines per ISO 9001:2015 Clause 7.1.5

- Material: Batch-level material certificates meeting EN 10204 3.1 standards

- Method: Standardized work instructions for 120+ bearing types (人、机、料、法、环、测 _人机料法环测指什么)

Certification maintenance requires quarterly internal audits and corrective action closure within 30 days, with digital traceability systems capturing 98% of production data in real-time through IoT-enabled process monitoring.

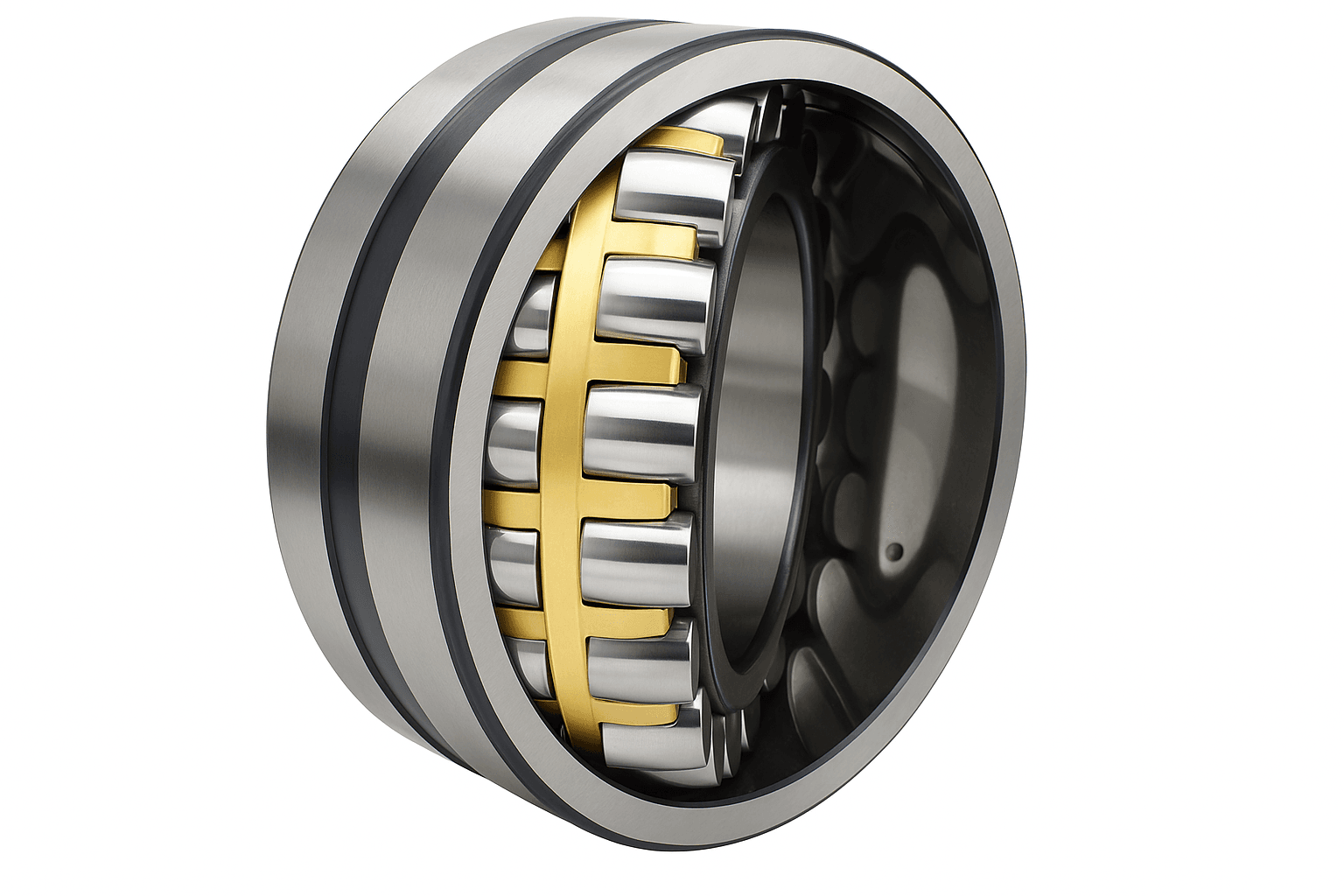

Product Types and Their Applications

Bearing factories produce a diverse range of precision components tailored to specific load conditions, operational environments, and industry requirements. From miniature deep groove ball bearings for medical devices to massive spherical roller bearings for wind turbines, this product diversity enables optimized performance across mechanical systems. The following sections detail three foundational bearing types, their engineering characteristics, and industrial applications.

Deep Groove Ball Bearings

Design Features:

- Single-row non-separable design with uninterrupted raceways

- Standard radial clearance of C0-C5 (ISO 5753)

- Optional shields (ZZ) or rubber seals (2RS) for contamination protection

Performance Advantages:

- Low friction: Torque values 30% lower than tapered rollers under equivalent loads

- High-speed capability: DN values up to 1.2 million (mm·r/min)

- Bidirectional axial load capacity: 25% of radial load rating

Industrial Applications:

| Sector | Application Examples | Special Requirements |

|---|---|---|

| Automotive | Alternator bearings, EV motor shafts | -40°C to +150°C operating range |

| Food Processing | Mixer shaft supports, conveyor rollers | FDA-compliant grease (USP Class VI) |

| Medical Devices | Surgical drill spindles | Sterilizable 316L stainless steel |

The sealed variants with FDA-grade lubrication are particularly critical in pharmaceutical production lines, where they prevent lubricant contamination while maintaining 0.01mm runout accuracy (带卡簧槽深沟球轴承在食品加工设备中的应用).

Cylindrical Roller Bearings

Structural Variants:

- NU/NJ types: Allow axial displacement of shafts

- NUP/N types: Provide axial positioning

- Full-complement designs: 20-35% higher radial capacity than caged versions

Operational Benefits:

- Heavy load capacity: Dynamic load ratings up to 1,500kN for 240mm bore sizes

- Misalignment tolerance: Up to 0.05° through crowned roller profiles

- Oil-film adaptability: Optimized for hydrodynamic lubrication in gearboxes

Key Implementations:

- Wind turbine main shafts: Multi-row NNU designs withstand bending moments from 6MW+ turbines

- Paper mill dryer sections: NJ2326 bearings operate at 120°C with Teflon-coated cages

- Mining crushers: FC2848 full-complement bearings endure 15g vibration loads

Recent innovations include integrated temperature sensors in bearing collars for predictive maintenance in offshore wind installations (圆柱滚子轴承在风力发电中的应用案例).

Tapered Roller Bearings

Configuration Principles:

- Contact angles (12°-30°) determine axial/radial load ratio

- Paired sets (DF/DB arrangements) manage bidirectional thrust

- Precision ground raceways ensure optimal load zone distribution

Technical Superiority:

- Combined load handling: Simultaneous radial and axial load support

- Adjustable clearance: Precisely set during assembly via spacer selection

- Damage resistance: Case-hardened surfaces withstand debris ingress

Automotive & Industrial Use Cases:

- Wheel hubs: TBU-4517 units integrate ABS sensors for passenger vehicles

- Railway axles: AP-150 tapered pairs endure 300,000km service intervals

- Steel rolling mills: Four-row TQOS series carry 8,000-ton slab loads

In heavy machinery, customized sealing systems on T2EE tapered rollers have extended lubrication intervals from 500 to 2,000 hours in quarry conveyor systems (圆锥滚子轴承 重型机械 细分应用).

Industry Trends and Future Outlook

The bearing industry is undergoing a transformative phase driven by technological innovation, shifting market demands, and intensifying global competition. This section examines the key developments shaping the sector’s evolution from 2024 to 2030.

Technological Advancements

Smart Bearing Systems are revolutionizing predictive maintenance capabilities:

- Integrated sensors monitor temperature (±1°C accuracy), vibration (FFT analysis up to 10kHz), and load distribution in real-time

- Wireless data transmission via Bluetooth 5.2 or LoRaWAN protocols enables cloud-based condition monitoring

- SKF’s Enlight ProCollect system reduces unplanned downtime by 45% in wind turbine applications (瑞典SKF(品质保证工业备件首选))

IoT Integration in bearing factories features:

- Digital twin simulations optimize grinding parameters with <2μm dimensional deviation

- Automated lubrication systems adjust grease viscosity based on operational telemetry

- NTN’s “Zero Downtime” initiative connects 92% of production equipment to central AI platforms (日本恩梯恩NTN公司官网,专业的轴承制造商)

Material Science Breakthroughs:

| Innovation | Performance Gain | Commercialization Status |

|---|---|---|

| Graphene-coated races | 80% friction reduction | Pilot production (2026) |

| Self-healing ceramics | 3× fatigue life | Laboratory validation |

| Metamaterial bearings | Noise reduction >15dB | NASA aerospace testing |

Market Growth Drivers

Renewable Energy Expansion:

- Global wind turbine installations require 2.8 million specialized bearings annually by 2030

- LYC’s 9-meter diameter offshore wind bearings withstand 20MW turbine loads (洛阳LYC轴承有限公司: 激发内生动力 做强产业集群)

- Hybrid ceramic bearings dominate solar tracker systems with 50,000+ hour maintenance-free operation

Electric Vehicle Revolution:

- EV-specific bearing demand grows at 28% CAGR through 2030

- NSK’s EV-specific tapered rollers reduce energy loss by 18% in 800V architectures (解密日本百年轴承巨头NSK的诞生路,至今技术仍旧占据前沿)

- Chinese manufacturers capture 35% of global EV bearing market with cost-optimized solutions

Industrial Automation Surge:

- Collaborative robots demand miniature bearings with <0.5μm runout accuracy

- TIMKEN’s CyberGear series achieves 50,000rpm in semiconductor wafer handlers (The Timken Company – Engineered Bearings & Industrial Motion)

- Smart factory investments drive 19% annual growth in linear motion bearings

Competitive Landscape

Global Leaders’ Strategies:

| Company | Strategic Focus | R&D Investment | Regional Expansion |

|---|---|---|---|

| SKF | Carbon-neutral production | 4.2% of revenue | Brazilian gigafactory (2026) |

| Schaeffler | EV powertrain integration | €1.3B/year | Michigan tech center expansion |

| NSK | Robotics components | 5.1% of revenue | Thai sensor bearing plant |

| NTN | Aerospace certifications | $980M 5-year plan | French SNR acquisition |

Chinese Domestic Players:

- LYC轴承: Military-civil integration with 23% defense revenue growth

- 瓦房店轴承: Heavy machinery focus, 15% market share in mining equipment

- 浙江天马: Full supply chain control from steelmaking to finished bearings (关于我们- 浙江天马轴承集团有限公司)

Emerging Threats:

- Indian manufacturers achieve 40% cost advantage in standard bearings

- Vietnamese producers capture 12% of ASEAN automotive bearing demand

- 3D-printed bearings disrupt spare parts logistics with on-site manufacturing

The industry’s future will be shaped by the convergence of precision engineering, digital transformation, and sustainable manufacturing practices. Chinese manufacturers are projected to capture 28-32% of the global high-end bearing market by 2030, challenging traditional Western and Japanese dominance (2024-2030年中国轴承行业前景展望与增长预测).

Conclusion and Key Takeaways

Summary of Critical Insights

The bearing manufacturing industry operates at the intersection of precision engineering and industrial demand, with factories demonstrating remarkable adaptability to evolving technological and market requirements. Three core operational pillars emerge from this analysis:

Precision-Centric Production: Bearing factories achieve micron-level tolerances (as tight as 0.001mm for aerospace components) through advanced processes like CBN wheel grinding (±2μm accuracy) and cryogenic treatment at -196°C (轴承生产工艺流程). This precision directly correlates with bearing performance metrics, including:

- Fatigue life exceeding 1 million cycles at 300kN loads

- Vibration levels <28dB for P5 grade bearings

- 50,000+ operational hours in industrial machinery

Material Innovation: The shift from traditional GCr15 steel (1.5% Cr content) to hybrid ceramic solutions demonstrates how material science drives performance:

Material Advancement Performance Gain Emerging Applications Silicon nitride ceramics 1,400°C thermal stability High-speed spindles Graphene-coated races 80% friction reduction EV motor bearings (pilot 2026) Self-healing ceramics 3× fatigue life Wind turbine shafts Digital Transformation: 92% of tier-1 factories now employ IoT-enabled real-time monitoring, with SKF’s Enlight ProCollect system reducing wind turbine downtime by 45% (瑞典SKF(品质保证工业备件首选)). This digital shift enables:

- Predictive maintenance through vibration FFT analysis up to 10kHz

- Digital twin simulations optimizing grinding parameters

- Full traceability from raw material to finished product

Final Thoughts

The bearing industry’s future competitiveness hinges on balancing three paradoxical demands:

1. Standardization vs Customization

While ISO 24652 and DIN 648 standards ensure global interoperability (我国主导制定的滚动轴承领域国际标准ISO 24652正式发布), emerging applications like surgical robotics require bespoke miniature bearings with <0.5μm runout accuracy. Chinese manufacturers have progressed from producing 66,000 bearing varieties in 2005 to over 90,000 by 2019 (市场预测:预计到2032年全球轴承行业市场规模将达到2,798亿美元), yet high-end segments remain dominated by international firms.

2. Cost Efficiency vs Technological Leadership

The industry faces a bifurcation:

- Volume Play: Chinese producers achieve 35% cost advantage in standard bearings through automated forging (95% material utilization)

- Value Play: Global leaders invest €1.3B/year in R&D (Schaeffler) for innovations like NASA-tested metamaterial bearings

3. Environmental Compliance vs Performance

REACH SVHC standards mandate <0.1% lead content, while IATF 16949 certification requires 85% grinding sludge recovery rates (IATF16949认证的核心内容有哪些 ISO9001认证的申请流程详解). This creates tension with performance requirements, as evidenced by:

- 34.83% price increase for轴承钢 in 2021 due to environmental compliance costs

- 18% energy loss reduction in NSK’s EV-specific tapered rollers

The path forward requires “precision sustainability” – achieving carbon-neutral production (as SKF’s Brazilian gigafactory targets by 2026) while maintaining micron-level accuracy. With Chinese manufacturers projected to capture 28-32% of the global high-end market by 2030 (2024-2030年中国轴承行业前景展望与增长预测), the industry’s evolution will increasingly be driven by renewable energy demands and smart man